EOM

Your partner for high-performing global operations

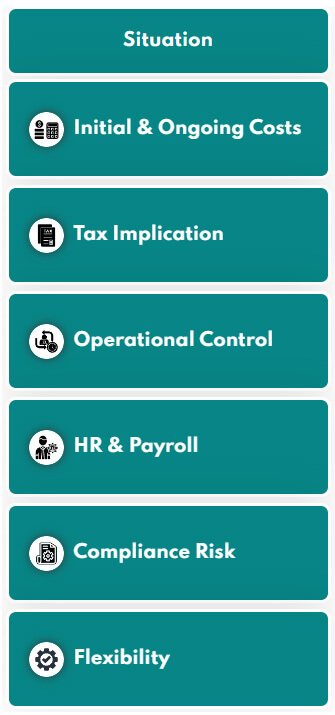

Situation

Local Entity Setup

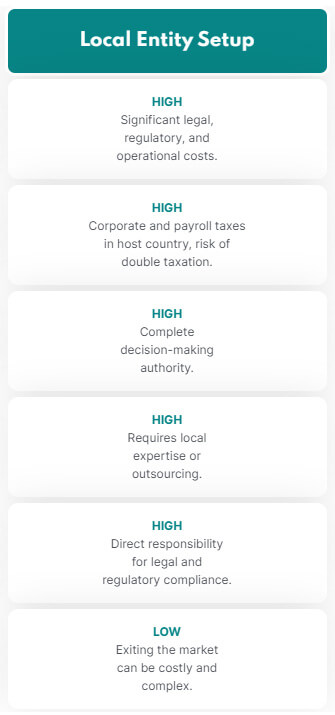

Secondment

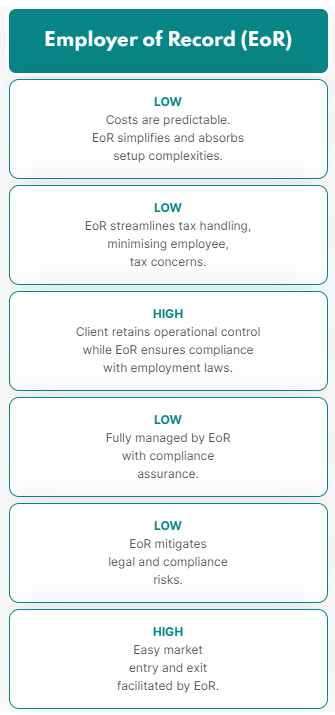

Employer of Record (EoR)

Initial & Ongoing Costs

High

Significant legal,

regulatory, and

operational costs.

High

Significant legal,

regulatory, and

operational costs.

Medium

Costs vary based on

assignment length and

agreements.

Medium

Costs vary based on

assignment length and

agreements.

Low

Costs are predictable.

EoR simplifies and absorbs

setup complexities.

Low

Costs are predictable.

EoR simplifies and absorbs

setup complexities.

Tax Implication

High

Corporate and payroll taxes

in host country, risk of

double taxation.

High

Corporate and payroll taxes

in host country, risk of

double taxation.

High

Employees face host country

taxes after 186 days, double

taxation agreements may apply.

High

Employees face host country

taxes after 186 days, double

taxation agreements may apply.

Low

EoR streamlines tax handling,

minimising employee,

tax concerns.

Low

EoR streamlines tax handling,

minimising employee,

tax concerns.

Operational Control

High

Complete

decision-making

authority.

High

Complete

decision-making

authority.

Medium

Governed by

secondment

terms.

Medium

Governed by

secondment

terms.

High

Client retains operational control

while EoR ensures compliance

with employment laws.

High

Client retains operational control

while EoR ensures compliance

with employment laws.

HR & Payroll

High

Requires local

expertise or

outsourcing.

High

Requires local

expertise or

outsourcing.

High

Coordination needed

between home and

host country laws.

High

Coordination needed

between home and

host country laws.

Low

Fully managed by EoR

with compliance

assurance.

Low

Fully managed by EoR

with compliance

assurance.

Compliance Risk

High

Direct responsibility

for legal and

regulatory compliance.

High

Direct responsibility

for legal and

regulatory compliance.

High

Risks in both

home and host

countries.

High

Risks in both

home and host

countries.

Low

EoR mitigates

legal and compliance

risks.

Low

EoR mitigates

legal and compliance

risks.

Flexibility

Low

Exiting the market

can be costly and

complex.

Low

Exiting the market

can be costly and

complex.

Medium

Dependent on secondment

duration and

conditions.

Medium

Dependent on secondment

duration and

conditions.

High

Easy market

entry and exit

facilitated by EoR.

High

Easy market

entry and exit

facilitated by EoR.

Choose strategic simplicity with EOM.

See Where We Offer Our Services.

Quick Guides to Employment Across Globe!

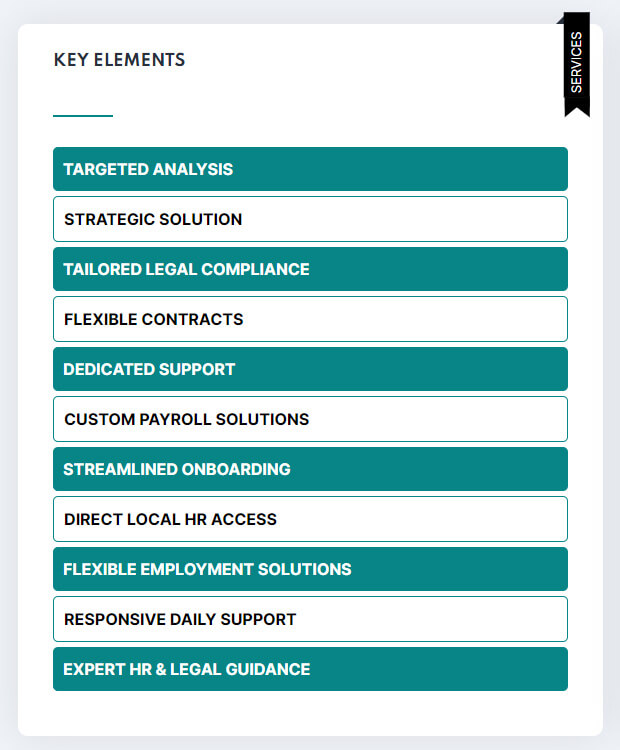

Key Elements

- Targeted Analysis

- Strategic Solution

- Tailored Legal Compliance

- Flexible Contracts

- Dedicated Support

- Custom Payroll Solutions

- Streamlined Onboarding

- Direct Local HR Access

- Flexible Employment Solutions

- Responsive Daily Support

- Expert HR & Legal Guidance

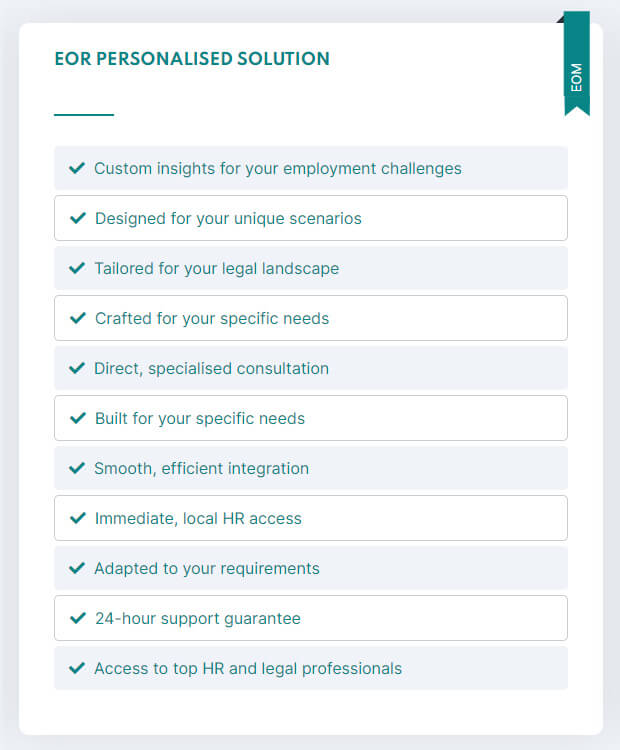

EoR Personalised Solution

- Custom insights for your employment challenges

- Designed for your unique scenarios

- Tailored for your legal landscape

- Crafted for your specific needs

- Direct, specialised consultation

- Built for your specific needs

- Smooth, efficient integration

- Immediate, local HR access

- Adapted to your requirements

- 24-hour support guarantee

- Access to top HR and legal professionals

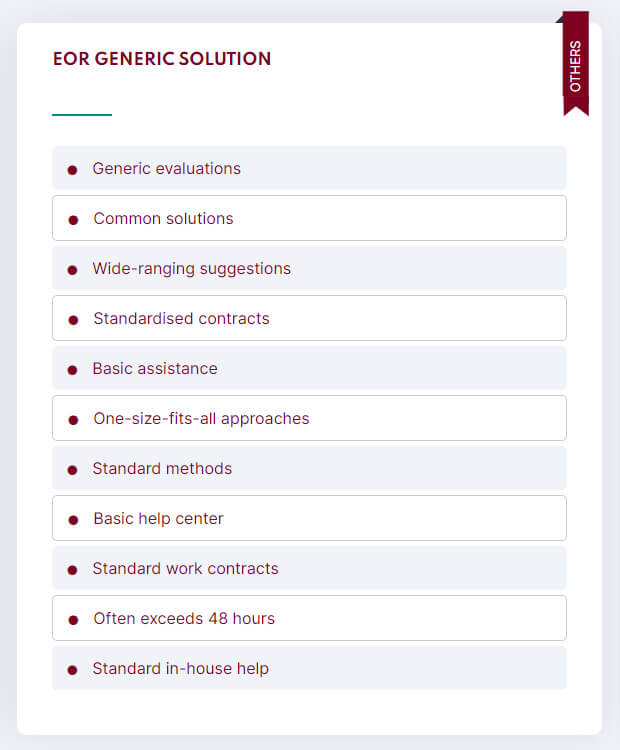

EoR Generic Solution

- Generic evaluations

- Common solutions

- Wide-ranging suggestions

- Standardised contracts

- Basic assistance

- One-size-fits-all approaches

- Standard methods

- Basic help center

- Standard work contracts

- Often exceeds 48 hours

- Standard in-house help

Request a Free Audit on Your Current Solutions Today!

Facilitating Remote Team Integration Across Europe

- Situation: A software development company based in Sweden adopted a remote-first approach and hired talent across Europe to build a diverse and skilled team.

- Challenge: Managing a remote team scattered across various European countries presented challenges in ensuring consistent HR practices, legal compliance, and fostering a unified company culture.

- Our Solution: Our EoR solution enabled the company to manage their remote workforce efficiently under a single framework. We ensured compliance with each country's employment laws, streamlined payroll and benefits, and supported the development of a cohesive remote work culture.

- Advantages: Compared to managing multiple contracts and legal requirements independently, our EoR services provided the company with a hassle-free solution to remote team management. This allowed them to leverage the benefits of a diverse European team while maintaining operational efficiency and a strong, integrated company culture.

Seamless Expansion from Italy to the Netherlands

- Situation: An Italian gourmet food distributor aimed to extend its market reach by opening a branch in the Netherlands to cater to the growing demand for authentic Italian cuisine.

- Challenge: The company was unfamiliar with Dutch employment laws and had difficulty hiring local staff to manage operations and sales.

- Our Solution: The company quickly hired local talent in the Netherlands by using our EoR services. We managed all employment responsibilities, from compliance with Dutch labour laws to payroll and benefits administration.

- Advantages: By partnering with us, the company bypassed the complexities of establishing a legal entity in the Netherlands and expedited their market entry. This approach not only saved significant time and resources but also allowed the company to focus on scaling their business and strengthening their brand presence in a new market.

Client: Major International Insurance Company

- Challenge: A European national working abroad sought to return to their home country to benefit from impatriates advantages and needed to go on assignment in a non-European country, which presented a unique logistical challenge.

- Limitation of Standard Solutions: Standardized EoR solutions could not meet this specific requirement.

- EOM's Custom Solution: Developed a customised solution to accommodate the unique needs of the client and their impatriate employee. Successfully navigated the complexities of impatriate employment regulations across borders.

- Outcome: EOM provided a bespoke solution where standard options fell short. Facilitated the employee's smooth transition back to their home country for the impatriate benefits, while also managing their assignment in a non-European country, ensuring compliance and employee satisfaction.

Client: Leading Aerospace Company with International Operations

- Challenge: An employee, officially on the payroll of a competitor abroad, faced issues with backdated tax, social security, and in-kind benefits calculations. The complexity was due to the employee receiving a national salary but in-kind benefits directly from the client overseas.

- Limitation of Standard Solutions: The competitor's standard payroll system was inadequate for reconciling the intricate backdated calculations needed due to the international aspect.

- EOM's Intervention: EOM intervened to tackle the unique challenge of accurately backdating and reconciling financial obligations and benefits across borders. Developed a bespoke solution that rectified the backdated discrepancies to the satisfaction of both the client and the consultant. Formulated a comprehensive solution for the current year to ensure smooth financial and benefits management going forward.

- Outcome: EOM's custom approach successfully resolved the backdated financial issues, ensuring compliance and satisfaction for the international client and the consultant. Implemented a proactive solution for the ongoing year, streamlining the international compensation and benefits arrangement, and setting a precedent for handling similar cases in the future.